3.10.1

The institution’s recent financial history demonstrates financial stability. (Financial stability)

Compliance Judgment

X In compliance Partially compliant Non-compliant

Narrative

Francis Marion University and its administration have been diligent over the years to ensure the university’s financial stability. Steady revenue trends, enrollment trends, financial reserves, budgetary oversight, and fiscal management controls and decisions are all factors to be evaluated in demonstrating the University’s stability.

Revenue

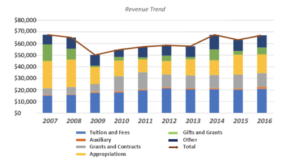

Revenue over the last ten years has been stable overall. During the great recessionary period of the 2000s, Francis Marion saw a drastic decline in state appropriations, and this decline was met with an offsetting increase in tuition and fee revenues. This data is provided in Figure 1 below.

Figure 1. Revenue Trend*

*Source: Data come from the FMU 2016-2017 Financial Indicator Matrix provided to the SC Commission on Higher Education.

Enrollment

Francis Marion has also ensured financial stability through steady enrollment. Being a small state institution, the University understands it is critical that academic program creation correspond to state and local job demands. Ensuring programs meet both the demands of the area and the desires of the student are key to maintaining steady enrollment.

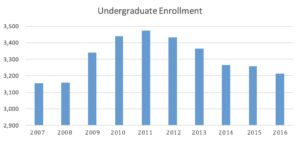

Undergraduate enrollment growth has been steady with overall growth of 1.8% over the ten-year period as seen in Figure 2 below.

Figure 2. Undergraduate Enrollment*

Source: Data come from the Office of Institutional Research at FMU.

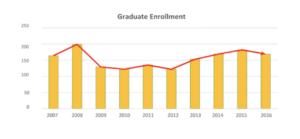

Graduate enrollment has also remained steady with growth of 3% over the ten-year period as seen in Figure 3.

Figure 3. Graduate Enrollment*

Source: Data come from the Office of Institutional Research at FMU.

Financial Behavior

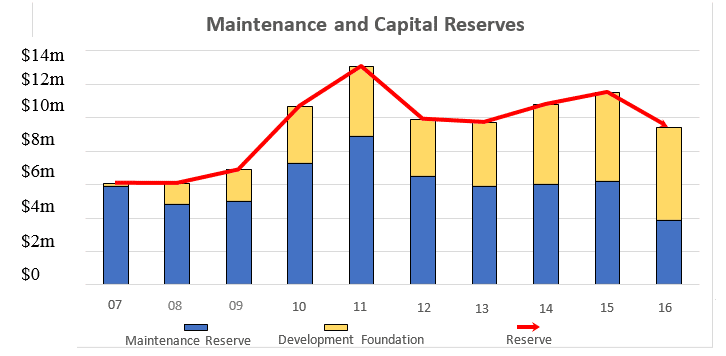

The University’s financial stability is also maintained through its financial base and behavior. Over the years, the University has sought to increase its maintenance and capital reserves in a conscious effort to ensure adequate funds are available for operating shortfalls should they occur as well as to ensure facilities can be adequately maintained. Many of the facilities on campus have begun approach the end of their depreciable life and that means that there is a growing demand for maintenance repair funding. The administration of the University is cognizant of this need and seeks to not only ensure University reserves are sufficient but also requests support via appropriations for maintenance of these facilities.

Debt Capacity

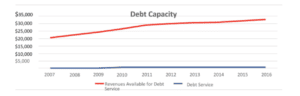

Overall, the university’s financial behavior has been typically debt averse relying heavily upon appropriations and tuition and fee revenue for both annual operations and capital projects. Capital construction has historically been through a wide range of revenue resources but typically was derived from capital gifts, state capital appropriations, internal capital reserve funds, and (only when deemed necessary) by the university’s Board of Trustees, debt financing. The debt capacity of the University is shown in Figure 4 below.

Figure 4. Debt Capacity*

*Source: Data come from the FMU 2016-2017 Financial Indicator Matrix provided to the SC Commission on Higher Education.

Maintenance Reserves

The maintenance reserve held by Francis Marion has decreased over the ten-year period, with an average decrease of 3.5% per year, but appears to be consistent with the increased operations and maintenance expenditures (at a rate of 4.8% per year). The development fund reserve held by Francis Marion has increased significantly in 2008, with an average increase of 38% per year over the past nine years.

Maintenance reserves temporarily covered $1.9 million in construction costs until gifted funds were received in the Fall 2016. These funds have since then been returned to the capital reserve. Fiscal year end 2017 balance will be available upon completion of the audit in Fall 2017. A detailed chart of the university’s maintenance and capital reserves in provided in Figure 5 below.

Figure 5. Maintenance and Capital Reserves*

*Source: Data come from the FMU 2016-2017 Financial Indicator Matrix provided to the SC Commission on Higher Education.

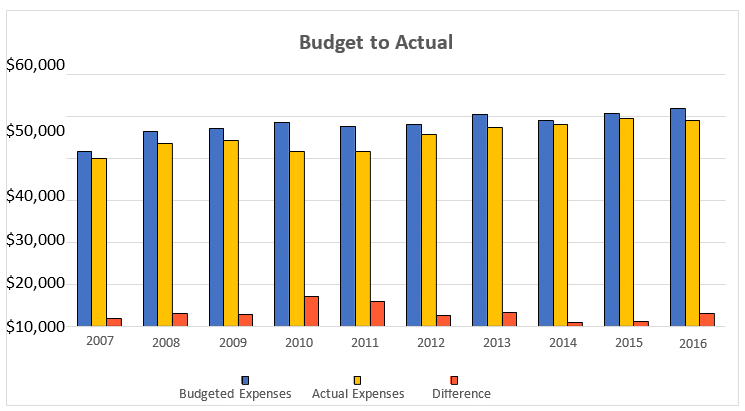

University Budgets

The University is vigilant at ensuring it lives within its financial means. The Board of Trustees, management, as well as departmental directors, monthly review financial reports to ensure budgets are adhered to. As support of the Board’s fiscal oversight, the Finance and Facilities Committee has monthly received a budget of the university’s operating account [1]. On a quarterly basis the full Board of Trustees receives a quarterly financial report of all university funds [2]. Management and departmental directors have the ability to automatically receive monthly printouts from our accounting system in the administration of their duties. The University also allows live reporting of budgetary reports through its Campus Application and Data Service portal [3]. Special ad hoc reports are also periodically prepared by the Office of Financial Services when requested by the President and Senior Administration and at the request of departments.

Over the last ten years, the University, through careful oversight and reporting as noted above, has been able to hold expenses within budget for annual operations. Evidence of this is displayed in Figure 6 below.

Figure 6. Budget to Actual*

*Source: Data come from the FMU 2016-2017 Financial Indicator Matrix provided to the SC Commission on Higher Education.

Francis Marion has consistently had actual expenses not exceed budgeted expenses in each of the past ten years by an average of $3.1 million per year.

Administrative Staff

The financial stability of Francis Marion University is lastly dependent upon the expertise of the administration and staff who are charged with the budgetary and fiscal oversight of the university’s operations. Table 1 below describes the qualifications and experience of current employees who oversee the budget and fiscal planning and ultimately have control of guiding the fiscal stability of the University.

Luther Carter

Ph.D. (Political Science), University of South Carolina

M.P.A. (Organizational Theory and Public Finance), University of South Carolina

President - Professor of Public Administration and Public Finance for 20 years

- Senior Executive Assistant for Finance and Administration to SC Governor Carroll Campbell for 5 years

- Chief of Staff to SC Governor Mark Sanford for 1 year

- President of Francis Marion University for 18 years

Peter King

Ph.D. (Zoology), North Carolina State University

Provost - Chair of Biology Department at Francis Marion University, 2007-2011

- Associate Provost for Enrollment Management at Francis Marion University, 2011-2016

John J. Kispert

M.S. (Management), Salve Regina University

M.A. (National Security and Strategic Studies), U.S. Naval War CollegeVP for Business Affairs - 4 years as Chief of Staff at Marine Corps Recruit Depot, Parris Island, SC

- 5.5 years as Chief of Staff at South Carolina Department of Juvenile Justice

- 16 years as VP for Business Affairs at Francis Marion University

Charlene Wages

Ph.D. (Psychology), Georgia State UniversityVP for Administration - 4 years Treasurer, Sigma Kappa House Corporation Board

- 3 years National Science Foundation Grant Budget Management

- 5 years Faculty Senate/Faculty Chair at Francis Marion University

- 12 years budget management/oversight for offices in Administration area at Francis Marion University

Darryl Bridges

M.A.E. (Student Personnel Services), Western Kentucky UniversityVP for Development/Executive Director of the Education Foundation - 26 years of experience in program administration in higher education (11 years at the VP level)

- Institute for Education Management, Harvard University (graduate)

- Mid-managers Institute, Southern Association of College Student Affairs (graduate)

- 10 years of experience in non-profit leadership/

management governance

Thomas Welch

M.B.A. (General Business), Southern Wesleyan University

B.B.A. (Accounting), Francis Marion UniversityAssistant VP for Financial Services - Certified Public Accountant

- Former Auditor for the State Auditor's Office

- Former Audit Manager and GAAP Accountant for the SC Governor's Office of Executive Policy and Programs

- Non-profit and governmental audit experience

- Grants management experience

- 7 years financial management experience in higher education

- 12 years financial management experience in state government

- 3 years as the Director for Financial Services at Francis Marion University

Cathy Swartz

M.Acc. (Accountancy), University of Tennessee Assistant VP for Accounting - 18 years accounting experience in state government

- 15 years accounting experience in higher education

- 11 years as the Director of Accounting Services and recently promoted to current position

- governmental audit experience

Eric Garris

M.B.A. (General Business), Francis Marion University Assistant VP for Purchasing - 6 years as the Director of Purchasing at Francis Marion University

- 15 years as the Assistant/Associate Director for Financial Information at Francis Marion University

Erika Cook

M.B.A. (General Business), Francis Marion University Executive Director of the Development Foundation - 3 years of experience as the Associate Director of Financial Services at Francis Marion University

- 2 years of experience in current position as the Executive Director of the Development Foundation

Table 1. Critical Personnel for Financial Oversight and Financial Stability

All staff must submit resumes and meet the State Office of Human Resources position classification requirements to be hired. Resumes and detailed support of each member’s qualifications for their position are on file in Francis Marion’s Office of Human Resources.

In summary, the University has a solid history of financial strength, prudent fiscal behavior, oversight, and adequate financial reserves that support the University and its academic and mission critical endeavors.